We all have certain financial goals in our life– buying a dream home, or a car, going on a long foreign vacation, providing the best education to children, getting them married in pomp and style, and finally living the golden years of life or retirement in bliss.

But merely investing in Solution-oriented Mutual Funds may not help fulfil many of these goals. Engaging in prudent financial planning is necessary on your part.

“Planning is bringing the future into the present so that you can do something about it now.” – Alan Lakein (a distinguished author on personal time management)

In the goal planning process, it is important to set S.M.A.R.T. (Specific, Measurable, Adjustable, Realistic, and Time-bound) financial goals, classify them as short-term, medium-term, and long-term (depending on the time-to-goal), and then devise an actionable investment strategy to achieve the envisioned goals.

In my view, you cannot purely invest in Solution-oriented Mutual Funds and ignore the other diversified equity mutual fund schemes. You need a bouquet of various mutual fund schemes that suit your risk profile, investment objective, financial goals, and investment time horizon.

Solution-oriented Mutual Funds, as per the regulatory guidelines, carry Retirement Fund’ or ‘Children’s Fund’ in their complete scheme nomenclature.

Note, Retirement Funds have a lock-in of 5 years or your retirement age, whichever is earlier. Similarly, Children’s Funds have a lock-in of 5 years or until the child attains the age of majority, whichever is earlier.

And depending on the allocation to equity, debt, or a mix of both of a Retirement Fund or Children’s Fund, it could be termed as aggressive, wealth creation, moderate, conservative, income generation, etc. and generate its returns.

Table 1: Performance of Solution-oriented Mutual Funds and Diversified Equity Funds

| Category Average | Absolute (%) | CAGR (%) | Risk-Ratios | |||||||

| 3 Months | 6 Months | 1 Year | 3 Years | 5 Years | SD Annualised | Sharpe | Sortino | |||

| Solution-Oriented Mutual Funds | ||||||||||

| Solution Oriented – Children’s Funds | -4.0 | -1.2 | 0.3 | 20.5 | 9.2 | 14.55 | 0.27 | 0.49 | ||

| Solution Oriented – Retirement Funds | -2.5 | 0.1 | 2.6 | 15.7 | 8.7 | 10.47 | 0.16 | 0.28 | ||

| Diversified Equity Mutual Funds | ||||||||||

| Contra Funds | -4.3 | 1.7 | 7.2 | 34.8 | 13.6 | 19.45 | 0.34 | 0.62 | ||

| Smallcap Funds | -4.1 | -2.4 | 2.4 | 43.0 | 13.3 | 22.73 | 0.36 | 0.63 | ||

| Multi Cap Funds | -5.5 | -2.0 | 1.4 | 31.5 | 12.7 | 20.46 | 0.29 | 0.50 | ||

| Midcap Funds | -5.2 | -3.9 | 1.5 | 33.2 | 12.0 | 20.46 | 0.31 | 0.53 | ||

| Dividend Yield Funds | -2.4 | 3.1 | 2.7 | 31.5 | 11.7 | 16.96 | 0.34 | 0.63 | ||

| Large & Mid Cap Funds | -5.7 | -2.0 | 0.5 | 29.0 | 11.5 | 19.50 | 0.28 | 0.47 | ||

| Flexi Cap Funds | -5.6 | -2.2 | -0.8 | 26.5 | 11.3 | 18.37 | 0.21 | 0.37 | ||

| Focused Funds | -5.9 | -2.0 | 0.0 | 26.7 | 10.9 | 18.58 | 0.25 | 0.45 | ||

| Large Cap Funds | -5.9 | -0.8 | 0.6 | 24.5 | 10.9 | 18.14 | 0.24 | 0.42 | ||

| Equity Linked Savings Schemes | -5.6 | -1.2 | 0.7 | 27.2 | 10.6 | 18.98 | 0.26 | 0.45 | ||

| Value Funds | -4.8 | 1.6 | 3.5 | 32.2 | 10.2 | 19.83 | 0.31 | 0.54 | ||

| S&P BSE SENSEX – TRI | -5.2 | 1.3 | 1.8 | 26.0 | 13.0 | 19.05 | 0.27 | 0.48 | ||

| NIFTY 50 – TRI | -6.2 | 0.1 | 0.2 | 26.6 | 12.1 | 18.97 | 0.27 | 0.48 | ||

| NIFTY 100 – TRI | -7.6 | -2.8 | -1.9 | 25.8 | 11.1 | 19.01 | 0.25 | 0.46 | ||

| NIFTY 200 – TRI | -7.4 | -2.7 | -1.4 | 27.0 | 11.0 | 19.31 | 0.26 | 0.47 | ||

| NIFTY 500 – TRI | -7.4 | -2.9 | -1.6 | 28.0 | 10.9 | 19.50 | 0.27 | 0.48 | ||

| Nifty Midcap 150 – TRI | -5.6 | -3.0 | 2.2 | 36.4 | 11.9 | 22.28 | 0.31 | 0.54 | ||

| Nifty Smallcap 250 – TRI | -8.4 | -5.0 | -7.0 | 40.5 | 7.3 | 26.27 | 0.30 | 0.52 | ||

(Data as of 27 March 2023)

The category average returns for both solution-oriented and various sub-categories of diversified equity mutual funds are shown for the Direct Plan-Growth option. Returns considered are point-to-point

Returns over 1 year are compounded annualised; else absolute.

Standard Deviation indicates Total Risk, while Sharpe and Sortino Ratios measure the Risk-Adjusted Return. They are calculated over a 3-Yr period assuming a risk-free rate of 6% p.a.

Past performance is not an indicator of future returns.

The table above is NOT a recommendation as such. Speak to your investment advisor for further assistance before investing.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

(Source: ACE MF, PersonalFN Research)

The table above reflects that Solution-oriented Mutual Funds, both Children’s Funds and Retirement Funds as a category, have lagged on wealth creation in a 5-year time frame compared to some of the sub-categories of diversified equity mutual funds. Solution-oriented funds aren’t bad per se, but what matters is a prudent selection. Only a few schemes such as HDFC Children’s Gift Fund, HDFC Retirement Savings Fund-Equity Plan, HDFC Retirement Savings Fund-Hybrid-Equity Plan, Aditya Birla SL Retirement Fund-30, Aditya Birla SL Retirement Fund-40, Axis Retirement Savings Fund-Aggressive Plan, and Axis Retirement Savings Fund-Dynamic Plan, have managed to generate respectable returns and alpha over a longer time frame.

Given that there is usually a 5-year lock-in (no option to redeem or switch until then) for Solution-oriented Mutual Funds — which, of course, ensures that you, the investor, stay invested for the long-term to reap higher gains — but in reality, if the scheme does not perform, it could derail the plan of achieving your financial goal.

On the other hand, in the case of certain open-ended diversified equity mutual funds (barring ELSS), you have the option to switch or redeem if the scheme falters (owing to various reasons) and move to the best-performing and suitable schemes. This nimble approach usually helps potentially clock an efficient return on investment and accomplish the envisioned financial goal/s.

If you are looking for a better alternative to fulfil your financial goals and not just depend on Solution-oriented Mutual Funds (or any other avenue), I suggest trying out PersonalFN’s SMART Fund Explorer right away! It is a simple yet effective tool that can help you plan for your financial goals.

How does the Smart Fund Explorer tool help in goal planning?

It helps you invest in mutual funds schemes considering your…

- Financial goal (buying a car, house, children’s education needs, your retirement, etc.)

- The number of years to goal, the amount you need in today’s term to achieve the envisioned goal

- The lumpsum investment you can make,

- And the SIP you can start per month.

At the backend, along with the aforementioned parameters, the inflation rate is also taken into account by the Smart Fund Explorer tool to determine the expected return you need to clock to achieve the financial goal and what could be the value of your investment at the target rate.

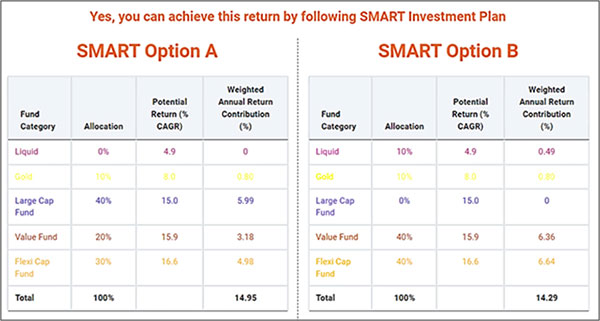

Thereafter, the Smart Fund Explorer tool provides you with two SMART Investment Options — SMART Option A and SMART Option B — which recommend you mutual fund schemes across categories (equity, debt, hybrid, etc.) and sub-categories therein.

Given that it’s vital to follow asset allocation, how much you need to allocate to every type of scheme is also made known to you along with the return potential for the respective type of fund.

You may select any of the SMART Investment Options as per your risk profile.

This is an astute and sensible approach to plan for your financial goals rather than investing randomly or copying someone else’s investment portfolio. Barry Ritholtz, an American author, newspaper columnist, and equity analyst, aptly states, “When it comes to investing, there is no such thing as a one-size-fits-all portfolio.” Keep in mind investing is an individualistic exercise.

How to access the Smart Fund Explorer tool?

Well, all you have to do is click on this link — https://www.personalfn.com/solutionbased.aspx — and follow the five simple steps below:

Step #1 – Select the type of goal (buying a house, a car, your child’s education, your retirement, etc.).

Step #2 – Enter the time frame you have to achieve the envisioned goal.

Step #3 – Enter the amount of money that you are willing to invest towards your goal.

Step #4 – The lumpsum investment you are ready to make for the goal, plus the monthly SIP amount.

Step #5 – Finally, click on the “Show me my SMART Investment Plan” button.

[Read: How You Can Use the ‘SMART Fund Explorer’ to Accomplish Your Financial Goals]

At PersonalFN, we understand that not everyone has the expertise to choose the best-suited mutual fund schemes for their envisioned financial goals, and hence developed the Smart Fund Explorer tool making it easier and smarter for you investors.

Therefore, don’t just simply depend on Solution-oriented Mutual Fund Schemes; they aren’t a definitive solution to plan for your financial goals. Avoiding Solution-oriented Mutual Fund Schemes and instead selecting among the category and sub-categories of mutual funds as per your risk profile, investment objective, and investment time horizon would help you wisely achieve many of your envisioned financial goals.

This article first appeared on PersonalFN here