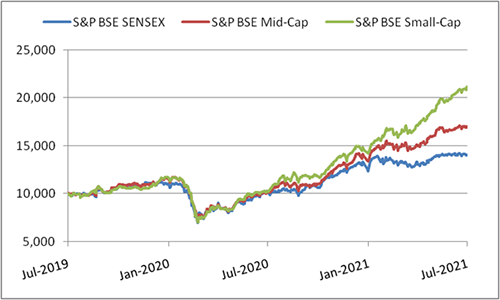

Since the market crash of March 2020, the equity market has shown an extraordinary rally. After stumbling to a multi-year low, the equity market not only recovered but also scaled new all-time high levels. Unlike the previous market rally, the market has been witnessing a broad-based rally with mid and small-caps joining the optimism. In fact, mid-cap and small-cap indices have outpaced the large-cap index in the last one year.

When the market is at all-time high, you would often hear experts suggesting to book profits from equity mutual funds and wait for the market to correct to reinvest. While there is no denying that market could correct, no one can predict when that will happen. Notably, the market could keep soaring for a very long time despite expensive valuations before it starts correcting. It could happen a month from now, 6 months, 1 year, or even 2 years later.

So, it would be imprudent to keep waiting for the market to correct, otherwise you may lose out on various investment opportunities. It is important to note that the advise you usually receive during extreme/volatile market conditions such as book profits from equity mutual fund, wait on the sidelines, invest in a particular theme/sector, etc. are meant for short-term traders and may not be suitable for long-term investors.

If you book profit during market highs, you may forego any potential growth in the future, thereby limiting the opportunities to earn higher alpha from your equity mutual fund. Redeem your equity mutual fund investments during a bull market only if:

- You have achieved your desired corpus for a financial goal.

- The equity mutual fund scheme consistently underperforms its peers and the benchmark.

- The fundamental attributes of a scheme has changed, which may not be suitable for you.

- Your investment objective has changed since your first investment.

- When facing a financial emergency and you need to liquidate your investments.

- Your asset allocation review warrants a change.

Graph: Equity market across capitalisation trading at all-time high

Base taken as 10,000

Data as on July 30, 2021]

(Source: ACE MF, PersonalFN Research)

Here are the investment strategies you can follow to generate alpha in a bull market with equity mutual funds:

1) Choose schemes carefully

During a bull market, investors often tend to chase performers. However, this is not the correct approach to select equity mutual fund schemes for your portfolio. Amidst the market rally since last year, most equity funds have generated decent returns. But this performance may or may not sustain in the future if the market starts to correct.

Therefore, it is important to choose schemes carefully. Select a scheme looking at its long term performance as well as its performance across various market cycles. Further, remember the true essence of alpha is to generate ‘extra return without taking extra risk’. Therefore, it is important to lay emphasis on the equity fund’s ability to generate a decent premium for the level of risk you have taken by assessing ratios such as Sortino Ratio, Sharpe ratio, Standard Deviation, etc.

2) Check fund manager’s efficiency

Active fund managers have the ability to exploit the advantages offered by the stock markets and create alpha in the long run. However, not every equity fund manager and fund will be successful. An equity mutual fund’s alpha generating ability very much depends on the expertise and ability of the fund manager in taking the right call at the right time and rewarding investors, irrespective of the market movement.

Hence, before investing in an equity fund during a bull market, check the track record of funds managed by him/her across various market phases. Additionally, have a look at the portfolio characteristics to get a good idea about the investment strategy and style that the fund manager follows.

3) Diversify your investment

It is easy to assume higher risk when the market environment is optimistic. You may be tempted to invest in riskier investment such as mid-cap fund and small-cap fund. However, it is advisable to diversify appropriately based on your personal asset allocation plan. If you disregard the asset allocation plan, you may feel the consequence when the market starts correcting.

It is important to diversify your investment suitably based on your financial goals, risk appetite, and investment horizon. For instance, diversify across mid-cap funds and small-cap funds only if you have a very high risk appetite and if the goal for which you are investing is at least 5-7 years away. Similarly, if you have a moderate risk appetite, you can diversify your investment in large-cap funds and flexi-cap funds.

4) Continue with the SIP

The market is currently at an all-time high and its upward trajectory is expected to continue in the long run. However, there could be lots of ups and downs on the way since volatility is the inherent nature of equity investment. When you invest regularly in equity mutual fund via SIP, such short term irregularities in the market become insignificant in the long run. Therefore, it is important to continue with your SIP even when the market is at all-time high.

Trying to time the market can be counter-productive because it can hinder your financial goals. Instead focus on goal-based investing by aligning your SIP investment to each of your envisioned goals. However, as the financial goal nears, gradually shift your exposure from equity mutual fund to stable avenues such as debt mutual fund schemes.

5) Avoid chasing momentum

One mistake that you should avoid during bull market is to accumulating too many schemes. Fund houses usually launch new fund offers (NFO) during market highs to capitalise on the positive investor sentiment. These products are positioned as unique proposition that can aid in capital appreciation and diversification. However, not all new funds are worthy of your investment. Invest in an NFO only if it offers diversification and unique proposition that cannot be fulfilled from your existing portfolio of diversified equity funds.

Ensure that you fully understand the nitty-gritties of a scheme and its place in the overall asset allocation plan before you invest in it. If you want to take the risk and invest in a fund offering a unique investment proposition, consider investing it as a part of your satellite portfolio. Limit the overall allocation to such funds to 10% of your overall portfolio.

To conclude…

Market movement should not be a worry for long-term investors. Choose suitable and worthy schemes based on your goals and risk tolerance and invest in a systematic manner via SIP.

This article first appeared on PersonalFN here