Welcome to PersonalFN’s weekly analysis on diversified equity mutual funds! In this issue, we have analysed ICICI Pru Equity & Debt Fund, highlighting its performance, peer comparison, investment strategy, fundamentals, portfolio, and suitability.

ICICI Pru Equity & Debt Fund is a highly favoured Aggressive Hybrid Fund with a strong history of outperforming in different market conditions. By emphasising long-term strategies, it has consistently provided investors with impressive returns relative to the risks involved.

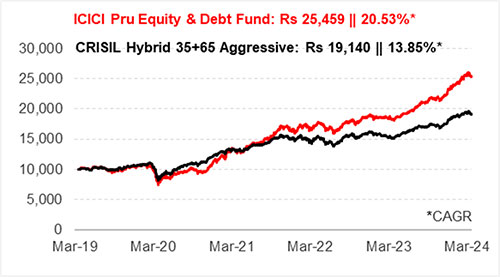

What is the growth of Rs 10,000 invested in ICICI Pru Equity & Debt Fund five years ago?

Past performance is not an indicator of future returns

Data as of March 20, 2024

(Source: ACE MF, data collated by PersonalFN)

Launched in November 1999, ICICI Prudential Equity & Debt Fund has been in existence for nearly 25 years. Since its inception, the fund has shown superior performance generating returns at around 15.4% CAGR, meeting the expectations of its investors in terms of overall performance. Being an Aggressive Hybrid Fund, ICICI Prudential Equity & Debt Fund is mandated to invest in a mix of equity and debt with an aim to generate long-term capital appreciation from its equity holdings and accrual income from its debt holdings.

ICICI Prudential Equity & Debt Fund has outpaced the benchmark and the category average by a significant margin in the past. This attracted investors to the fund, thereby enabling it to become the second-largest scheme in the category with an AUM of Rs 32,429 crore. Although the fund has not always been the top performer in the Aggressive Hybrid Fund category, it has done reasonably well to outperform the benchmark and many of its category peers over longer time frames.

Even though the fund’s performance was sluggish during the 2020 market crash, it made a strong comeback in the ensuing recovery and bull phase to reward its investors with superior gains.

Over the past five years, the scheme has generated returns of 20.5% CAGR compared to 13.9% CAGR generated by the benchmark CRISIL Hybrid 35+65 Aggressive Index, thus outpacing the index by a CAGR of around 6.6 percentage points. An investment of Rs 10,000 in ICICI Prudential Equity & Debt Fund five years back would have now appreciated to Rs 25,459, whereas a simultaneous investment in its benchmark would now be worth Rs 19,140.

How has ICICI Pru Equity & Debt Fund performed on a rolling return basis?

| Scheme Name | Corpus (Cr.) | 1 Year | 2 Year | 3 Year | 5 Year | 7 Year | Std Dev | Sharpe |

| Quant Absolute Fund | 1,788 | 15.19 | 14.91 | 29.96 | 21.93 | 18.11 | 14.24 | 0.39 |

| ICICI Pru Equity & Debt Fund | 32,429 | 21.86 | 18.45 | 28.61 | 17.85 | 16.49 | 10.90 | 0.47 |

| Bank of India Mid & Small Cap Equity & Debt Fund | 657 | 24.57 | 13.97 | 28.27 | 16.81 | 16.99 | 15.05 | 0.36 |

| JM Aggressive Hybrid Fund | 202 | 28.32 | 16.50 | 25.40 | 15.00 | 13.26 | 12.07 | 0.40 |

| Edelweiss Aggressive Hybrid Fund | 1,353 | 21.59 | 15.57 | 23.04 | 15.76 | 14.29 | 9.97 | 0.41 |

| Mahindra Manulife Aggressive Hybrid Fund | 1,033 | 19.31 | 13.44 | 22.90 | — | — | 11.15 | 0.34 |

| UTI Aggressive Hybrid Fund | 5,243 | 19.58 | 13.35 | 22.61 | 13.35 | 12.56 | 10.51 | 0.34 |

| Kotak Equity Hybrid Fund | 5,045 | 16.62 | 12.33 | 22.27 | 15.96 | 14.11 | 9.84 | 0.31 |

| Nippon India Equity Hybrid Fund | 3,399 | 19.51 | 13.08 | 21.89 | 9.10 | 10.20 | 10.44 | 0.32 |

| HDFC Hybrid Equity Fund | 22,643 | 16.95 | 12.65 | 21.34 | 13.85 | 13.55 | 10.37 | 0.27 |

| CRISIL Hybrid 35+65 – Aggressive Index | 13.75 | 9.34 | 16.23 | 12.73 | 12.50 | 9.54 | 0.23 |

The securities quoted are for illustration only and are not recommendatory.

Returns are on a rolling basis and in %. Direct Plan-Growth option. Those depicted over 1-Yr are compounded annualised. Risk ratios are calculated over a 3-year period assuming a risk-free rate of 6% p.a.

Data as of March 20, 2024

(Source: ACE MF, data collated by PersonalFN)

Please note, this table only represents the best-performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully before investing. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

ICICI Prudential Equity & Debt Fund has a history of rewarding investors over the long term, despite facing challenges over shorter time periods. The fund’s performance dipped in 2020, falling behind the benchmark and many of its peers by a notable margin. However, the fund has shown significant improvement in performance in recent years. Over the last 1-year, 2-year, and 3-year periods, ICICI Prudential Equity & Debt Fund has outperformed the benchmark CRISIL Hybrid 35+65 Aggressive Index by a substantial margin of around 8-12 percentage points on a rolling returns basis, surpassing most of its peers as well.

This has placed the fund among the top performers in the Aggressive Hybrid Fund category, with enhanced performance across different time frames. Over the longer periods of 5 years and 7 years, the fund has outperformed its benchmark and the category average by around 3.5-5 percentage points.

However, this outperformance has come at higher volatility compared to the benchmark and some of its category peers. Nonetheless, ICICI Prudential Equity & Debt Fund has effectively rewarded investors for the level of risk taken, as denoted by its Sharpe Ratio of 0.47, which is currently among the best in the category and significantly exceeds that of the benchmark.

What is the investment strategy of ICICI Pru Equity & Debt Fund?

Categorised under Aggressive Hybrid Funds, ICICI Prudential Equity & Debt Fund is mandated to invest 65% to 80% of its assets in equities and 20% to 35% of its assets in debt and money market instruments. Under normal circumstances, the fund maintains at least 65% allocation to equities and up to 35% in debt.

ICICI Prudential Equity & Debt Fund predominantly follows a combination of the top-down and bottom-up approaches to picking stocks across market capitalisation. While the top-down approach enables the fund to select stocks from an array of industries and thus reduce risk exposure, the bottom-up approach enables it to select individual companies having strong performance potential. The fund managers do not resist taking contrarian bets on beaten-down sectors and stocks, to benefit from market anomalies.

The potential stocks are analysed on parameters such as long-term growth prospects, price-to-earnings ratio, dividend income potential, and earnings power. Following a ‘blend’ style of investment, ICICI Prudential Equity & Debt Fund gives high impetus to long-term growth strategies and follows a buy-and-hold strategy to derive the full potential of stocks in the portfolio.

For its debt allocation, ICICI Prudential Equity & Debt Fund intends to tactically invest in longer duration fixed income securities with a credit rating of AA and above, aiming to generate reasonable income through regular accruals. It seeks to take exposure in well-researched corporate securities to earn reasonable interest income. The fund also invests in fixed-income securities issued by the government, quasi-government agencies, and corporate and multilateral agencies.

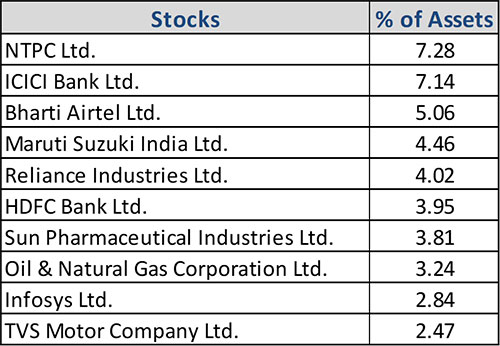

What are the top portfolio holdings in ICICI Pru Equity & Debt Fund?

|  |

Holding in (%) as of February 29, 2024

(Source: ACE MF, data collated by PersonalFN)

ICICI Prudential Equity & Debt Fund allocates about 65-70% of its assets in equities and usually holds a large portfolio of 65-75 stocks. As of February 29, 2024, the fund’s portfolio was diversified across 77 stocks with the top 10 stocks accounting for 44.3% of the portfolio. The fund held its top exposure in large-cap names like NTPC, ICICI Bank, Bharti Airtel, Maruti Suzuki India, and Reliance Industries. Many of the stocks in its top 10 holdings have been part of the fund’s portfolio for several years now.

ICICI Prudential Equity & Debt Fund’s allocation is skewed to the top holdings, leaving behind a long tail of over 60 stocks with an exposure of less than 1% in each. The fund holds most of its stocks with a long-term view and has thus recorded a low turnover ratio of 25-35% in the last one year.

In the last two years, NTPC, Tata Motors – DVR Ordinary, Bharti Airtel, ICICI Bank, ONGC, TVS Motor Company, Sun Pharma, and ITC were among stocks that turned out to be major contributors to the fund’s performance. It also benefitted substantially from its holdings in L&T, SBI, HCL Technologies, Axis Bank, and Chalet Hotels, among others.

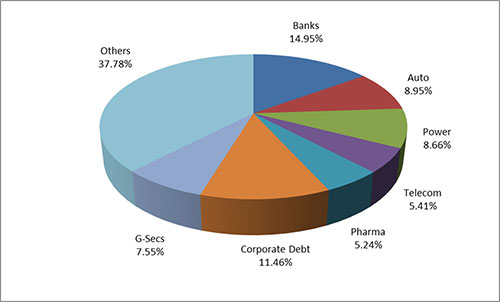

ICICI Prudential Equity & Debt Fund’s portfolio is diversified across a wide range of sectors with Banks & Finance having the highest exposure of 18.4%. This is in contrast to other popular schemes in the category that easily hold a quarter of their portfolio in Banking and Finance stocks. Auto, Power, Telecom, Pharma, Petroleum, and Infotech follow with an allocation between 4% to 9%. It holds diversification to Oil & Gas, Engineering, Retail, Consumption, and Hotels among others.

ICICI Prudential Equity & Debt Fund allocates around 20% of its assets in debt instruments mainly in GSecs and Treasury bills. It also holds exposure to moderate-to-high rated corporate debt and commercial papers, with a minor allocation to low-rated instruments carrying high credit risk. The debt securities carry average maturity of 5-10 years which makes it highly sensitive to interest rate risk. However, the fund has the flexibility to shift the duration of the portfolio if the situation so requires.

Is ICICI Pru Equity & Debt Fund suitable for my investment goals and risk tolerance?

ICICI Prudential Equity & Debt Fund has demonstrated an impressive performance over longer time periods. While the fund typically maintains a large-cap bias, it has the flexibility to adjust market cap allocation in the portfolio based on the valuation in a particular segment and prevailing market conditions.

The fund’s debt portfolio primarily consists of highly liquid sovereign rated G-Secs, supplemented by some allocation to moderate-rated corporate debt instruments, which can enhance the returns.

Led by highly experienced fund manager Mr Sankaran Naren, known specifically for his contrarian approach and value style of investing, the fund has a superior track record to its credit. Mr Naren has been very successful in picking stocks with a contrarian view.

ICICI Prudential Equity & Debt Fund is suitable for those seeking growth of equity while also prioritising stability through substantial allocation to debt and money market instruments, having an investment horizon of at least 3-5 years.

Note: This write up is for information purpose and does not constitute any kind of investment advice or a recommendation to Buy / Hold / Sell a fund. Returns mentioned herein are in no way a guarantee or promise of future returns. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

This article first appeared on PersonalFN here