Investors are delighted after seeing a good appreciation in their portfolio values as the equity markets bounced back and recorded significant gains in the last few weeks. The Indian markets have shown signs of optimism despite the adverse global environment, soaring USD, stubbornly high inflation level, and the hawkish stance of the RBI (which has raised policy repo rates by 190 bps so far this year).

For quite some time, the sentiments in the domestic markets have been driven by rising inflation, increasing global interest rates (after rate hikes by the central banks worldwide), policy rate hikes by the RBI, depreciating INR, and FPI sell-offs. There are still concerns about the higher inflationary trends across the globe and about the approaching recession next year, which may make the current recovery short-lived.

While there has been a rally across market cap segments, with most of the stocks and sectors moving up significantly, there are still several fundamentally sound stocks and sectors that are temporarily discarded by investors and are available at a deep discount to their fair value. The key is to timely identify such stocks and sectors and stay put until their full potential is realised.

Contra Funds aim to invest in such cheaply available stocks and out-of-favour sectors that are available at a significant discount to their fair valuation but have the potential to grow significantly. During market highs, such stocks offer a better margin of safety which gives them the potential to generate decent returns over the long run.

But with only three contra-style funds cumulatively managing a corpus of just around Rs 17,167 crore, they are less popular among investors. Among these, Invesco India Contra Fund is currently the largest scheme with an AUM of Rs 9,669 crore. This contra-style fund has done reasonably well in terms of performance and has rewarded its long-term investors with decent gains.

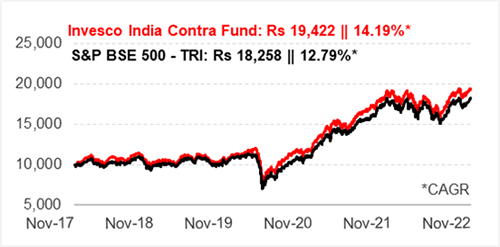

Graph 1: Growth of Rs 10,000 if invested in Invesco India Contra Fund 5 years ago

Past performance is not an indicator of future returns

Data as on November 07, 2022

(Source: ACE MF)

Invesco India Contra Fund is a contra-style equity scheme that follows against-the-tide kind of investment approach. It has benefited from timely contrarian bets by investing in stocks and sectors that are temporarily out of favour and available at a significant discount to their fair valuation. Incepted in April 2007, Invesco India Contra Fund remained unnoticed for almost 10 years. However, its spectacular performance during the bull market phase of 2016-2020 helped it gain the attention of investors. In addition, the fund managed to limit the downside risk during the market crash of 2020 compared to its category average and the benchmark. In the last 5 years, Invesco India Contra Fund has appreciated at a CAGR of around 14.2%, which is higher than the 12.8% CAGR delivered by its benchmark S&P BSE 500 – TRI. An investment of Rs 10,000 made in the fund 5 years back would have appreciated to Rs 19,422. A simultaneous investment of Rs 10,000 in the benchmark S&P BSE 500 – TRI would have been valued at Rs 18,258.

Table: Invesco India Contra Fund’s performance vis-á-vis category peers

| Scheme Name | Corpus (Cr.) | 1 Year | 2 Year | 3 Year | 5 Year | 7 Year | Std Dev | Sharpe | Sortino |

| SBI Contra Fund | 6,154 | 13.94 | 44.09 | 31.12 | 15.11 | 15.82 | 23.61 | 0.32 | 0.49 |

| Invesco India Contra Fund | 9,669 | 3.82 | 26.39 | 20.11 | 14.19 | 16.63 | 22.82 | 0.21 | 0.31 |

| Kotak India EQ Contra Fund | 1,344 | 5.53 | 27.56 | 19.21 | 14.77 | 16.34 | 23.15 | 0.19 | 0.28 |

| S&P BSE 500 – TRI | 3.29 | 26.56 | 18.58 | 12.79 | 14.53 | 23.19 | 0.19 | 0.28 |

Returns are point to point and in %, calculated using Direct Plan-Growth option. Those depicted over 1-Yr are compounded annualised.

Data as on November 07, 2022

(Source: ACE MF)

*Please note, this table only represents the best-performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully. Past performance is not an indicator of future returns. The percentage returns shown are only for indicative purposes.

Invesco India Contra Fund holds a superior track record and figures in the list of top-quartile performers among diversified equity funds over the longer time periods recorded in the past. It has distinctly outperformed the benchmark S&P BSE 500 – TRI across time periods. Notably, in the last 3-year, 5-year, and 7-year periods, the fund has managed to generate a decent alpha of about 1.5-to 2 percentage points over the benchmark. During the market crash of 2020, Invesco India Contra Fund was distinctly ahead of the category average as well as its benchmark. However, it couldn’t keep pace during the recovery phase and has marginally trailed the benchmark and its peers, which has adversely impacted its near-term performance.

Invesco India Contra Fund has fared well on risk-reward parameters. The fund has registered lower volatility compared to the benchmark and category peers and has been effective in generating reasonable risk-adjusted returns for its long-term investors. Its Sharpe ratio of 0.21 and Sortino of 0.31 look better compared to its benchmark, though lower than its top-performing peer SBI Contra Fund. The fund has well-compensated its investors for the level of risk taken.

Investment strategy of Invesco India Contra Fund

Invesco India Contra Fund is positioned to follow a contrarian investment strategy to timely pick fundamentally sound stocks from sectors that are temporarily out of favour or beaten-down stocks that are available at a significant discount. Accordingly, the fund managers pick ‘neglected stocks’ with strong asset values while focusing on under-owned sectors carrying high growth potential. The aim is to have a first-mover advantage by investing in out-of-favour sectors/stocks, thus increasing the long-term out-performance prospects.

While investing, the fund managers look for temporarily ignored but fundamentally sound stocks and carry high conviction in their long-term growth potential, holding them in the portfolio until their intrinsic value is achieved. Accordingly, the fund managers identify and invest in potentially undervalued stocks across sectors utilising the ‘top-down’ and ‘bottom-up’ approach and believe in incubating such stocks for a while before they find favour with the rest of the market. The fund managers also try to proactively identify new investment themes, examine the play on the relative attractiveness of mid-caps and large-caps, and adjust the market cap of the portfolio towards higher return potential opportunities.

While the fund managers are on a constant hunt for stocks available at cheap valuations and look at timely entry and exit, moderate churning in Invesco India Contra Fund’s portfolio cannot be ruled out.

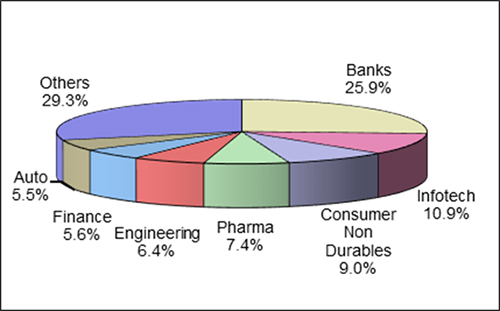

Graph 2: Top portfolio holdings in Invesco India Contra Fund

|  |

Holding in (%) as of October 31, 2022

(Source: ACE MF)

Invesco India Contra Fund usually holds a well-diversified portfolio of 45-55 stocks at any point in time. As of October 31, 2022, the fund held a well-diversified portfolio of about 61 stocks, with the top 10 stock holdings accounting for around 45.4% of its assets. Highly liquid large-cap names like ICICI Bank, HDFC Bank, Infosys, Reliance Industries, and SBI currently appear among the top holdings in the fund’s portfolio. Sun Pharma, Axis Bank, L&T, NTPC, and HUL currently stand among the other top holdings in the portfolio. Most of these stocks have been among the core contenders in the fund’s portfolio for a long time.

In the last couple of years, Invesco India Contra Fund has benefited immensely from its holdings in stocks like ICICI Bank, HDFC Bank, Infosys, Sun Pharma, Reliance Industries, HCL Technologies, Bharat Electronics, Tech Mahindra, KEI Industries, Cipla, Ultratech Cement, KNR Constructions, etc.

The top 5 sectors in Invesco India Contra Fund’s portfolio accounted for around 59.6% of its assets. It holds higher weightage in Banking & Finance, followed by Infotech, Consumption, Pharma, Engineering, and Auto. Petroleum, Power, Cement, Construction, Consumer Durables, and Telecom figure among the other prominent sectors in the fund’s portfolio.

The fund’s portfolio is diversified across market caps, with around 73% of its assets in large caps, along with 13.5% in midcaps and 9% in small-cap stocks.

Suitability

Invesco India Contra Fund holds a superior long-term performance track record and has the ability to deliver market-beating returns over longer time periods. It follows a contrarian investment strategy to timely pick fundamentally sound stocks from sectors that are temporarily out of favour or beaten-down stocks that are available at a significant discount.

During the 2020 market crash, Invesco India Contra Fund took advantage of picking beaten-down fundamentally sound stocks at attractive price points. But as the growth sentiment kicked in, this Contra Fund suffered in performance as it couldn’t participate and fully capitalise on the swift market recovery. Nevertheless, the fund has the potential to bounce back strongly.

Invesco India Contra Fund is suitable for investors with a high risk appetite and seeking exposure in an actively managed Contra Fund with an investment horizon of at least 5-7 years. As Contra Funds invest in ‘out-of-favour’ themes, they may temporarily underperform in the short term and hence deserve patience.

This article first appeared on PersonalFN here