The Indian equity market has seen high volatility in 2022 due to various macroeconomic and other domestic and global factors. Given the current market conditions, mid-cap and small-cap stocks have significantly decreased in price and are available at lower valuations. Many investors consider this a good entry point to diversify your portfolio with small-cap and mid-cap funds. The Mid-cap companies are considered to be emerging future market leaders or future large caps.

Mid-cap investing intends to capture companies with growth potential and evolving business models that carry moderate risk. Compared to both large and small caps, the average earnings of midcaps grow faster, with less volatility and risk. Despite the fact that mid-cap companies can provide higher returns, they are riskier than large-cap funds. Investing in the mid-cap segment through passive funds is a suitable alternative for investors who can stomach the high risk and are seeking a low-cost passive option for their mid-cap portfolio. They are less risky than vanilla Mid-cap funds and generate similar returns.

If you are looking for long-term growth opportunities in the mid-cap segment, along with inflation-beating returns over time, you could consider investing in the Nifty Midcap 150 index. This index covers the entire mid-cap market segment and is well-diversified across several sectors.

SBI Mutual Fund has launched SBI Nifty Midcap 150 Index Fund; it is an open-ended scheme tracking Nifty Midcap 150 Index.

Commenting on the launch of this fund, Mr D P Singh, Deputy MD & Chief Business Officer at SBI Mutual Fund, said, “As a fund house, we continue to expand our bouquet of offerings in the passive investment space. Mid and Small-cap Index Funds provide a gateway to investors looking to tap into the growth potential of these emerging businesses as they move up the market capitalisation curve from being small caps to mid-caps and eventually large caps. Investors, especially first-time equity investors, can consider investing in these funds in line with their risk profile for their long-term wealth creation goals.”

Table 1: Details of SBI Nifty Midcap 150 Index Fund

| Type | An open-ended scheme tracking Nifty Midcap 150 Index | Category | Index Fund |

| Investment Objective | The scheme's investment objective is to provide returns that closely correspond to the total returns of the securities as represented by the underlying index, subject to tracking error. However, there is no guarantee or assurance that the investment objective of the scheme will be achieved. | ||

| Min. Investment | Rs 5,000/- and in multiples of Re 1 thereafter. Additional purchase Rs 1,000/- and in multiples of Re 1 thereafter. | Face Value | Rs 10/- per unit |

| Plans |

|

Options |

|

| Entry Load | Not Applicable | Exit Load |

|

| Fund Manager | Mr Harsh Sethi | Benchmark Index | Nifty Midcap 150 TRI |

| Issue Opens: | September 21, 2022 | Issue Closes: | September 26, 2022 |

(Source: Scheme Information Document)

The investment strategy for SBI Nifty Midcap 150 Index Fund will be as follows:

SBI Nifty Midcap 150 Index Fund will adopt a passive investment strategy. The scheme will invest in stocks comprising the Nifty Midcap 150 index in the same proportion as in the index with the objective of achieving returns equivalent to the Total Returns Index of the Nifty Midcap 150 index by minimising the performance difference between the benchmark index and the scheme.

The scheme will primarily invest in the securities constituting the underlying index. However, due to changes in the underlying index, the scheme may temporarily hold securities which are not part of the index. For example, the portfolio may hold securities not included in the respective underlying index as a result of certain changes in the underlying index, such as reconstitution, addition, deletion etc.

The fund manager would endeavour to rebalance the portfolio in order to mirror the index; however, there may be a short period where the constituents of the portfolio may differ from that of the underlying index. These investments which fall outside the underlying index, as mentioned above, shall be rebalanced within a period of 7 calendar days.

A small portion of the fund may be invested in money market instruments to meet the liquidity requirements. Subject to the Regulations and the applicable guidelines, the scheme may invest in other Mutual Fund schemes. The investment strategy shall be in line with the asset allocation as defined for the scheme.

Under normal circumstances, the Asset Allocation will be as under:

Table 2: Asset Allocation for SBI Nifty Midcap 150 Index Fund

| Instruments | Indicative Allocation (% of net assets) | Risk Profile | |

| Minimum | Maximum | High/Medium/Low | |

| Securities covered by Nifty Midcap 150 Index | 95 | 100 | Medium to High |

| Money Market instruments* including triparty repo and units of liquid mutual fund^ | 0 | 5 | Low |

* Money market instruments include commercial papers, commercial bills, treasury bills, triparty repo, Government securities having an unexpired maturity up to one year, call or notice money, certificate of deposit, usance bills, and any other like instruments as specified by the Reserve Bank of India from time to time.

^The scheme may invest in Mutual Fund units to the extent of 5% of total assets.

(Source: Scheme Information Document)

About the benchmark

The NIFTY Midcap 150 represents the next 150 companies (companies ranked 101-250) based on full market capitalisation from the NIFTY 500. This index intends to measure the performance of mid-market capitalisation companies.

The NIFTY Midcap 150 Index is computed using the Free-float market capitalisation method, wherein the level of the index reflects the total Free-float market value of all the stocks in the index relative to a particular base market capitalisation value.

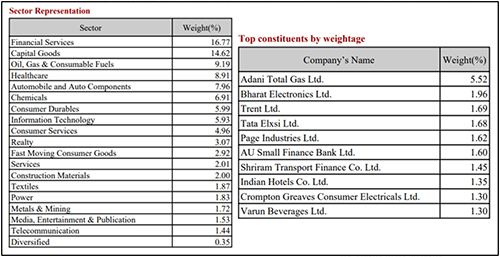

Here’s the list of top constituents by weightage and sector representation under the index as on August 30, 2022:

(Source: NSE Nifty Midcap 150 Index)

Note that the index will rebalance semi-annually.

Who will manage SBI Nifty Midcap 150 Index Fund?

The designated fund manager for this scheme is Mr Harsh Sethi. He is a CA, CS and B.com (Hons.) graduate and has an overall experience of 15 in the financial services industry. He joined SBIFML in May 2007 as a Product Manager and was responsible for product development and management. Prior to joining SBIFML, he was working with J. P. Mangal & Co. as a Senior Assistant handling Audit & Taxation.

At SBI Mutual Fund, Mr Sethi currently manages SBI ETF IT, SBI Consumption ETF, and SBI Private Bank ETF.

Fund Outlook – SBI Nifty Midcap 150 Index Fund

SBI Nifty Midcap 150 Index Fund aims to mirror the performance of the Nifty Midcap 150 Index, which captures the movement of the mid-cap segment of the market. The scheme endeavours to invest in securities in a similar proportion as the underlying index to generate parallel returns, subject to tracking errors.

SBI Nifty Midcap 150 Index Fund offers investors an opportunity to participate in the entire mid-cap segment of the market by passively investing in the underlying index. A portfolio of high-quality mid-sized companies with robust business models may hold the potential to become tomorrow’s large caps. The fortune of this scheme will be closely linked to how the Nifty Midcap 150 Index performs.

However, do note that even though the scheme is a relatively low-cost option to participate in the midcap segment of the market, investment in mid-cap stocks is a high-risk – high-return investment proposition. Midcap stocks are more exposed to price corrections during an economic downturn or volatile market phase.

Additionally, the persistent repercussions of geopolitical tensions, spiralling inflation, and hike in policy rates to curb demand and control inflation may cause a significant risk to economic growth. The margin of safety appears to be narrow, and the clear direction for the equity market from the current elevated levels is uncertain. These factors, among others, may impact the top constituents of the index, and the portfolio may face intensified volatility in the near term.

Thus, this scheme is suitable for investors who are seeking long-term capital appreciation through investments in securities covered by the Nifty Midcap 150 Index and gain access to the potential growth of the midcap companies in the underlying index. Ensure that you have a high-risk appetite with a long investment horizon of at least 5-7 years to sustain the market volatility, and your investment objective should be aligned with the fund.

This article first appeared on PersonalFN here