Factor investing can assist boost diversification, lower volatility, and improve portfolio performance. In India, the momentum factor has attracted investor sentiments and is slowly gaining traction. Momentum investing is the practice of buying and selling assets depending on the strength of current market movements. It is based on the concept that if a price move has enough momentum behind it, it will continue in the same direction.

Momentum investing aims to profit from market volatility by buying short-term positions in equities that are rising and selling them as soon as they start to fall. The momentum investing strategy is not biased towards a specific industry, market cap, or stock. It entails following trends in which various industries may gain traction at various points in the business cycle. Similar to surfing on the waves of the ocean, the goal of this strategy is to profit from stock price volatility in the near future.

One of the easiest ways to invest in a momentum strategy is by taking exposure to the Nifty 200 Momentum 30 Index. Conceptualised by the NSE, this Index brings together 30 stocks sorted on the basis of momentum factor from the Nifty 200 universe. Recently, several fund houses have launched schemes based on momentum factor investing.

Joining the bandwagon, IDFC Mutual Fund has launched the IDFC Nifty200 Momentum 30 Index Fund. It is an open-ended scheme tracking Nifty200 Momentum30 Index.

On the launch of this fund, Mr Vishal Kapoor, CEO at IDFC Mutual Fund, said “Momentum investing has proven to be a highly rewarding factor strategy over the last several years. It has also outperformed the broader indices, for instance, the Nifty200 Momentum 30 Index has outperformed the Nifty 100, and Nifty 200 indices in 8 out of the last 10 calendar years. It follows a structured, quantitative-led process of buying securities when their price is rising and importantly, selling them when prices appear to have peaked. Historically, returns per unit of risk for the momentum index have been higher than broader indices.”

Table 1: Details of IDFC Nifty 200 Momentum 30 Index Fund

| Type | An open-ended scheme tracking Nifty200 Momentum30 Index | Category | Index Fund |

| Investment Objective | The investment objective of the Scheme is to replicate the Nifty200 Momentum 30 index by investing in securities of the Nifty200 Momentum 30 Index in the same proportion/weightage to provide returns before expenses that closely correspond to the total return of the Nifty200 Momentum 30 Index, subject to tracking errors. However, there is no assurance or guarantee that the objectives of the scheme will be realized and the scheme does not assure or guarantee any returns |

||

| Min. Investment | Rs 5,000 and in multiples of Re 1/- thereafter. Additional Purchase Rs. 1000/- and in multiples of Re. 1/- thereafter. | Face Value | Rs 10/- per unit |

| SIP/STP/SWP | Available | ||

| Plans |

|

Options |

|

| Entry Load | Not Applicable | Exit Load | Nil |

| Fund Manager | Mr Nemish Sheth | Benchmark Index | Nifty 200 Momentum 30 Total Return Index |

| Issue Opens | August 19, 2022 | Issue Closes | August 26, 2022 |

(Source: Scheme Information Document)

The investment strategy for IDFC Nifty200 Momentum 30 Index Fund will be as follows:

IDFC Nifty200 Momentum 30 Index Fund will be managed passively with investments in stocks in a proportion to the weights of these stocks in the Nifty200 Momentum 30 Index.

The schemes will follow the momentum strategy that aims to capitalise on the continuance of existing trends in the market. It follows certain risk management rules to address volatility and other hidden traps that reduce profits. The approach uses a stringent set of guidelines that provide market entry and exit points for specific assets based on technical data.

The investment strategy would revolve around reducing the tracking error to the least possible through rebalancing of the portfolio, considering the change in weights of stocks in the index as well as the incremental collections/redemptions from the scheme. The performance of this scheme may not be commensurate with the performance of the underlying Index on any given day or over any given period. Such variations are commonly referred to as tracking errors. The scheme intends to maintain a low tracking error by aligning the portfolio in line with the Index.

The portfolio shall be rebalanced within 7 calendar days to ensure adherence to the asset allocation norms of these schemes. A small portion (0-5% of the Net Assets) of the scheme may be kept liquid to meet the liquidity and expense requirements.

Under normal circumstances, the asset allocation will be as under:

Table 2: Asset Allocation for IDFC Nifty200 Momentum 30 Index Fund

| Instruments | Indicative Allocations (% of Net Assets) | Risk Profile | |

| Minimum | Maximum | High/Medium/Low | |

| Securities belonging to the Nifty200 Momentum 30 Index | 95 | 100 | High |

| Debt & Money Market instruments | 0 | 5 | Low to Medium |

(Source: Scheme Information Document)

About the Benchmark

The Nifty200 Momentum 30 Index aims to track the performance of 30 high momentum stocks across large and mid-cap stocks within the Nifty 200 Index. The Index constitutes only those stocks that are eligible for derivative trading from the Nifty 200 index universe. From this, it selects the top 30 stocks with the highest ‘normalised momentum score’.

The Normalised Momentum Score for each stock is determined based on recent 6-month and 12-month price returns, adjusted for volatility. Stock weights are based on a combination of the stock’s Normalised Momentum Score and its free-float market capitalisation.

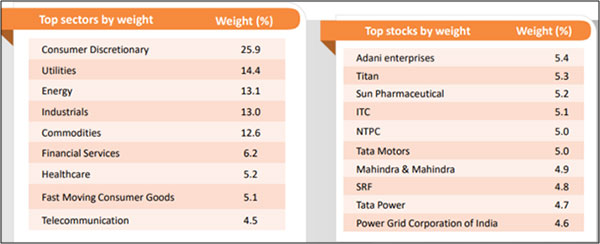

Here is the list of the top 10 constituents by weightage and sector representation of the Index as of July 31, 2022:

(Source: IDFC Nifty200 Momentum 30 Index Fund PPT)

Note that the index will rebalance semi-annually in June and December.

Who will manage IDFC Nifty200 Momentum 30 Index Fund?

The designated fund manager for this scheme is Mr Nemish Sheth. He is a B.com graduate and holds a Post Graduate Diploma in Management studies – Finance and has an overall experience of 12 years in the financial services industry. Prior to joining IDFC AMC, he was earlier associated with Nippon Life India Asset Management Ltd. and ICICI Prudential Asset Management Company Ltd. as a Dealer handling execution of Equity, Arbitrage and ETF trades.

At IDFC Mutual Fund, Mr Sheth currently manages, IDFC Arbitrage Fund, IDFC Equity Savings Fund, IDFC Nifty 100 Index Fund, IDFC Nifty Fund, IDFC Sensex ETF and IDFC Nifty ETF.

Fund Outlook – IDFC Nifty200 Momentum 30 Index Fund

IDFC Nifty200 Momentum 30 Index Fund aims to invest in securities comprising the Nifty 200 Momentum 30 Index and generate parallel returns, subject to tracking errors. The scheme endeavours to benefit from factor investing through a momentum factor strategy.

The Nifty200 Momentum 30 Index consists of 30 companies selected from the Nifty 200 index based on their normalised momentum score. The underlying index aims to capture the swift movement across stocks and sectors. Amidst the pandemic uncertainties, the momentum index adapted to the market swings at the time of the next rebalancing and increased its exposure to suitable stocks and sectors accordingly. The dynamic nature of the index makes investing beneficial for the investor over the long term.

The underlying index is overweight on some of the fast-growing high momentum stocks from the sectors like Metals, Consumer Services, Chemicals, Power and Capital Goods. The scheme endeavours to capitalise on volatile market trends by investing in stocks that are on their way up and selling them before the prices start falling as per the underlying index. The momentum method is a risky and aggressive investment strategy built on the premise that stocks and sectors with a recent track record of success will continue to do so and vice versa.

This makes these schemes high-risk, high-return investment propositions, as the funds focusing on momentum investing may go through a period of underperformance if there is any sharp change in market dynamics. In addition, the scheme is prone to high market risk due to the persistent repercussions of the Russia-Ukraine conflict, rising interest rates, and spiralling inflation which may pose a significant risk to economic growth. The margin of safety appears to be narrow, and the clear direction for the equity market from the current elevated levels is unknown. These factors, among many others, may affect the scheme’s performance, and the portfolio may face higher volatility in the near term.

The fortune of this scheme depends on the performance of the underlying index. Thus, the scheme is suitable for refined investors with a high-risk appetite and a long investment horizon of at least 5-7 years to sustain various market phases.

This article first appeared on PersonalFN here