Amidst the on-going coronavirus pandemic, the Indian equity market hit an all-time high (12,938.25 points on Nifty 50 on November 18, 2020).

Rise in economic activity after COVID-19 restrictions were eased and the pent-up demand during the festive season, indicatively pushed India’s economy on the road to recovery (after a sharp GDP growth contraction of -23.9% reported in Q1FY20).

Further, positive developments on the COVID-19 vaccine — with players such as Pfizer, Moderna, BioNTech claiming 95% efficacy in their vaccine trials — provided tailwinds to the rally.

Since April 2020, the market breadth has been largely positive and robust. In fact, the advance-decline ratio of stocks listed on the National Stock Exchange (NSE) touched a two-decade high in August this year when 175 stocks rose for every 100 falling. Even now the advance-decline ratio is reasonably strong.

Retail investors have been actively engaging in the Indian equity market backed by comfortable liquidity conditions. And many of them are first-time investors in equities who are anticipating better risk-adjusted real returns because the returns offered by some of the traditional avenues — such as bank deposits and small savings schemes — do not look very attractive to build wealth. Millions of new demat accounts and trading accounts have been opened since the nationwide COVID-19 lockdown was imposed in March 2020, reveals the capital market regulator’s data. As a consequence, retail participation rose to an 11-year high as of September 2020 quarter.

Will the Indian equity markets live up to the expectations and build wealth?

Well, there are certain positives or tailwinds…

Improvement in corporate earnings

Corporate India has reported an impressive performance in Q2FY21, largely on account of intense cost rationalizations. Consumer discretionary and consumer non-discretionary companies have seen an uptick in sales volumes and many of them have gone back to their pre-COVID levels. Companies belonging to technology, pharma, and banking have done remarkably well. Real estate and cement companies haven’t done too badly either.

But now the real question is, how much of this earnings momentum will sustain beyond Q2. Industry leaders have kept their guidance cautiously optimistic emphasizing on the need to monitor post-festival volumes. In my view, the stimulus measures taken by the government would provide support, but until we have an effective, ethical, and widely available COVID-19 vaccine to handle the pandemic, earnings may remain under strain; uneven earnings may be reported.

Vaccine in sight

The economic downturn that we have been witnessing globally stems from a medical emergency that coronavirus has created over the last twelve months. Thus, any positive news on vaccine would be extremely heartening for the global economy as well as the capital markets. Having said that, the vaccine needs to be ethical although effectual in the short-run, i.e. have no major side-effects on the populace in the long run, and should be widely available to contain the spread of the deadly pathogen.

Production-Linked Incentive may give a boost to domestic manufacturing

The Production-Linked Incentive (PLI) scheme, which is approved by the Union Cabinet with earmarked Rs 1.46 trillion for incentives over five years to ten sectors (namely: Pharmaceuticals, Automobile and Auto components, Telecom and Networking Products, Advanced Chemistry, Cell batteries, Textile, Food products, Solar Modules, White Goods, and Specialty Steel) might encourage domestic manufacturing. Further, it could drive investments into India from China (and other parts of the world), providing impetus to the government’s ‘Make in India’ initiative. Some industry honchos, such as Mr Anand Mahindra, have called this a “game-changer” development.

US election is out of the way

With Democrats winning decisively in the recently held U.S. Presidential election, the geopolitical tensions have seemingly alleviated. It is perceived that the world would sleep better under U.S. President-elect Joseph Biden (or Joe Biden as he is popularly known).

Nevertheless, it remains to be seen how the new regime handles various issues such as the trade war situation with China, the spread of the virus in the U.S., and fiscal situation in the world’s largest economy, among others, when Mr Biden takes over in January 2021.

The Federal Reserve (Fed) has already mentioned that it will be tolerant as regards inflation, if need be, to support economic recovery. Less hawkish monetary policy situation in the U.S. and a lenient stance on bi-lateral relations with China may provide some relief to equity markets.

But along with the aforesaid tailwinds, there are certain headwinds as well…

The high fiscal deficit would discourage government spending

Government spending has been the major driver of economic activity ever since the outbreak of the COVID-19 pandemic. However, with India’s fiscal deficit already climbing to 115% of full-year target; the Modi-led-NDA government may go slow on spending, which, in turn, may have a bearing on the pace of the economic recovery. The government has set a disinvestment target of Rs 2.1 lakh crore for FY21 which is unlikely to be met, going by its progress until now. The shortfall could be as high as 50%.

High inflation may push the interest rates up

Persistent policy rate cuts and proactive management of the liquidity in the system by the Reserve Bank has supported the economic recovery — let’s not forget that. However, with CPI inflation reading for October 2020 at 7.61% (well over the Reserve Bank‘s upper tolerance limit of 6.00%), it may pose a challenge for Reserve Bank to cut policy rates further to support growth even though the stance of the monetary policy is kept “accommodative as long as it is necessary.”

Obscure picture of demand trends

Despite all the good news we hear about the economic recovery, demand needs to pick up more and turn broad-based. At present, the rural economy has remained a saviour — and lone rural demand may not be enough to pull the economy on the path to recovery. Urban participation is necessary for a broad-based increase in demand. Furthermore, demand must improve after the festive season.

What investors should do at this juncture?

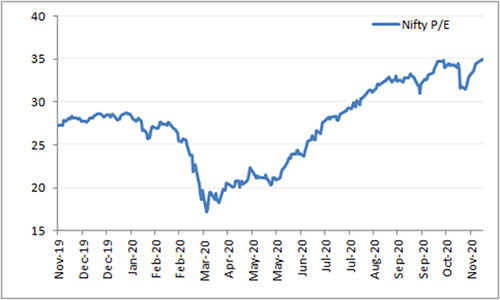

Approach equities as an asset class carefully and strategically. Valuation-wise, the Indian equity markets appear more stretched compared to the pre-COVID times. Even the mid and small-cap indices have recovered sharply and the margin of safety, therefore, seems to have narrowed.

Graph: Expensive valuations

Data as on November 17, 2020

(Source: NSE, PersonalFN Research)

Many of the tailwinds seem to have pushed the markets way ahead of fundamentals. If you remember, towards the end of 2007 as well, the Indian equity markets were in an exuberant phase supported by aggressive retail buying. But later, the market meltdown of 2008 pulled the rug underneath many investors.

What should be the strategy to follow?

I suggest investors follow the ‘Core & Satellite’ approach to invest in equity mutual funds. It is a time-tested investment strategy followed by some of the most successful investors to build a portfolio.

The term ‘Core’ applies to the more stable, long-term holdings of the portfolio, while the term ‘Satellite’ applies to the strategic portion that would help push up the overall returns of the portfolio, across market conditions. Plus, the ‘Satellite’ portfolio provides the opportunity to support the ‘Core’ by taking active calls based on extensive research.

The ‘Core’ holding should comprise around 65-70% of your equity mutual fund portfolio and consist of a large-cap fund, multi-cap fund, and a value/contra style fund. Whereas, the ‘Satellite’ holdings of the portfolio can be around 30-35% comprising of a mid-cap fund, a large & mid-cap fund, and an aggressive hybrid fund.

To build a ‘Core & Satellite’ portfolio of some of the best equity mutual fund schemes, here are some ground rules:

- Consider funds that have a strong track record of at least 5 years and have been amongst the top performers in their respective categories

- The schemes should be diversified across investment styles and fund management

- Ensure that each selected scheme abides with its stated objectives, indicated asset allocation, and investment style

- You should not only invest across investment styles (such as growth and value) but also across fund houses

- The mutual fund schemes should be managed by experienced and competent fund managers and belong to fund houses that have well-defined investment systems and processes in place

- Not more than five schemes managed by the same fund manager should be included in the portfolio

- Not more than two schemes from the same fund house shall be included in the portfolio

- Each scheme that is to be included in the portfolio should have seen an outperformance over at least three market cycles

- You should restrict the count of mutual fund schemes in your portfolio to seven

And once you create an all-weather portfolio, monitor it at regular intervals (bi-annually), rather than timing the market.

If you construct the mutual fund based on the ‘Core &Satellite’ approach, here are six benefits that would adduce:

- Facilitate optimal diversification;

- Reduce the need for constant churning of your entire portfolio;

- Reduce the risk to your portfolio;

- Enable you to benefit from a variety of investment strategies;

- Create wealth cushioning the downside

- Potentially to outperform the market

Be an intelligent investor, be more careful at this juncture than overly optimistic.

This article first appeared on PersonalFN here