Though small cap stocks generally tend to be highly volatile, the small cap category has been under immense pressure over the last two years. This poor performance can be attributed to expensive valuations in the segment until a couple of years ago, prolonged economic slowdown, and demonetization. Post the pandemic outbreak, the category lost more ground, delivering devastating returns.

However, if chosen carefully, they can outpace its large-sized peers. With economy limping back to normalcy and the government & RBI announcing measures to support growth, the segment could be on track to make a comeback. This coupled with attractive valuations is making investors bullish on the growth potential.

Axis Smallcap Fund (ASCF) is one such smallcap fund that lays high emphasis on picking quality stocks and has clearly stood out in terms of performance in the recent small cap crash.

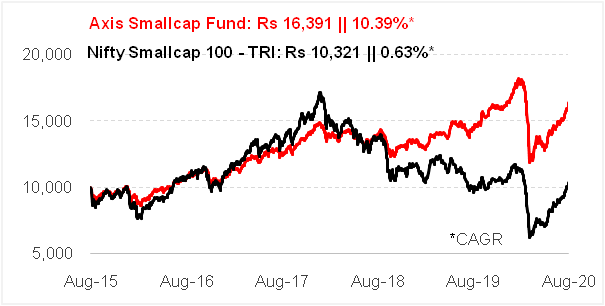

Graph 1: Growth of Rs 10,000 if invested in Axis Smallcap Fund 5 years ago

Data as on August 19, 2020

(Source: ACE MF)

The fund’s performance until 2 years ago was nothing to write home about. However, it clearly stood out in the recent small cap crash and has turned out to be the top category performer. ASCF has almost established itself in the small-cap space and is gradually garnering the attention of investors. Its focus on high quality growth stocks and superior stock picking ability of the fund management has driven the performance of the fund, which has rather helped it avoid downside during the recent crash witnessed in the lower market cap segment. Over the last 5-year period, ASCF has generated returns at 10.4% CAGR, thereby clearly outperforming the benchmark Nifty Smallcap 100 – TRI which generated negative returns of 0.6% CAGR.

Table: Axis Smallcap Fund’s performance vis-à-vis category peers

| Scheme Name | Corpus (Cr.) | 1 Year (%) | 2 Year (%) | 3 Year (%) | 5 Year (%) | 7 Year (%) | Std Dev | Sharpe |

| Axis Small Cap Fund | 2,472 | 13.07 | 8.63 | 9.46 | 10.38 | NA | 21.76 | 0.056 |

| SBI Small Cap Fund | 4,270 | 18.81 | 2.53 | 8.47 | 12.77 | 27.23 | 25.08 | 0.046 |

| Kotak Small Cap Fund | 1,494 | 17.38 | 1.38 | 2.83 | 7.61 | 20.45 | 25.79 | -0.016 |

| Nippon India Small Cap Fund | 8,322 | 14.16 | -3.13 | 2.79 | 9.61 | 25.65 | 27.26 | -0.013 |

| Union Small Cap Fund | 328 | 23.87 | -0.19 | 1.99 | 4.06 | NA | 25.17 | -0.037 |

| HDFC Small Cap Fund | 7,851 | -1.17 | -7.80 | 1.47 | 7.45 | 16.16 | 25.53 | -0.030 |

| DSP Small Cap Fund | 4,650 | 17.14 | -0.96 | -0.02 | 6.19 | 23.30 | 26.81 | -0.051 |

| ICICI Pru Smallcap Fund | 1,199 | 6.41 | -0.86 | -0.58 | 4.36 | 12.52 | 27.26 | -0.038 |

| L&T Emerging Businesses Fund | 4,796 | -0.72 | -10.37 | -3.47 | 7.23 | NA | 25.21 | -0.086 |

| Franklin India Smaller Cos Fund | 5,244 | -3.57 | -10.56 | -4.81 | 3.51 | 18.29 | 24.13 | -0.109 |

| Nifty Smallcap 100 – TRI | 2.48 | -13.00 | -8.32 | 0.63 | 12.57 | 32.70 | -0.084 |

Returns are point to point and in %, calculated using Direct Plan – Growth option. Those depicted over 1-Yr are compounded annualised.

Data as on August 19, 2020

(Source: ACE MF)

*Please note, this table only represents the best performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

With a spectacular performance in the recent small cap crash, ASCF has scripted an unbeatable track record of generating substantial alpha for its investors. The fund has outperformed its benchmark and category peers with a noticeable margin and has found place among the top performers in the small cap category across various time frames.

What makes ASCF far more attractive is its ability to generate returns even in conditions where most of its small cap peers have been struggling to limit downside. ASCF has registered far lower volatility (standard deviation) when compared to its similar category peers and the benchmark. The cautious investment approach followed at the fund house has helped ASCF deliver superior risk-adjusted returns for its investors.

Investment strategy of Axis Smallcap Fund

ASCF is mandated to invest a minimum 65% of its assets in equity & equity related instruments of small cap companies. Accordingly, ASCF endeavours to invest primarily in high conviction small cap stocks. It also holds significant exposure of about 10-25% in midcaps.The fund house employs a ‘Fair value’ based research process to analyse the appreciation potential of each stock in its universe. The universe of stocks is carefully selected to include companies having robust business models and enjoying sustainable competitive advantages as compared to their competitors.

When building the portfolio, the fund management team follows a bottom-up approach to investing with focus on appreciation potential of individual stocks from a fundamental perspective. It seeks to identify long term businesses, keeping in mind risk and reward, by containing mistakes and navigating volatile stock movements.

The fund house believes that the key to successful investing in smallcaps is patience and the ability to withstand short-term volatility. ASCF utilises a holistic risk management strategy, in order to manage risks associated with investing in equity markets.

Graph 2: Top portfolio holdings in Axis Smallcap Fund

Holding in (%) as on July 31, 2020

(Source: ACE MF)

ASCF is selective in its stock picks and invests in a fairly diversified portfolio of about 35-45 stocks. As on July 31, 2020, ASCF held 47 stocks spread across small and mid cap space. Among its top holdings the fund held names like Galaxy Surfactants, JK Cements, Can Fin Homes, Aarti Industries, and Fine Organic Industries. The top 10 stocks in the portfolio together accounted for around 37.3% of its assets. The fund does not follow an over-diversification strategy and holds meaningful exposure in each stock it has in the portfolio.

ASCF has benefited from its exposure to stocks like Coforge (earlier known as NIIT Technologies), Neogen Chemicals, Galaxy Surfactants, Ipca Laboratories, Fine Organic Industries, JK Cement, etc., which have turned out to be the major contributors to its performance in the last one year.

Chemicals dominate ASCF’s portfolio with an allocation of close to 20%. Financials account for another 15% in the portfolio. The presence of Cement, Construction and Engineering among the top sectors indicates that the fund manager anticipates benefits from economic recovery. The fund also holds significant exposure in Infotech, Consumer Durables, Consumption, Health Services, Auto ancillaries and so on. Overall, the fund’s portfolio is well positioned to participate in the market recovery.

Suitability

ASCF has been agile enough to take advantage of various investment opportunities present in the small-cap space as well as mid-cap segment. It aims to invest in high growth-oriented quality stocks available at attractive valuations and hold it with a long term view until full potential is derived. Despite being a growth oriented small cap fund with an aggressive nature, ASCF does not resort to taking aggressive calls or momentum bets and focuses on quality. This improves its chance of riding out tough market conditions. The aggressive investment mandate along with higher allocation to mid caps makes ASCF suitable for investors having a higher risk appetite and a long term investment horizon of at least 5-7 years.

Note: This write up is for information purpose and does not constitute any kind of investment advice or a recommendation to Buy / Hold / Sell a fund. Returns mentioned herein are in no way a guarantee or promise of future returns. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

This article first appeared on PersonalFN here