Welcome to PersonalFN’s weekly analysis on diversified equity mutual funds! In this issue, we have analysed Kotak Emerging Equity Fund, highlighting its performance, peer comparison, investment strategy, fundamentals, portfolio, and suitability.

Kotak Emerging Equity Fund is a well-managed scheme in the Mid Cap Mutual Fund segment that has performed consistently well across market phases in the past. Focusing on high-conviction bets, it has the potential to generate market-beating returns in the long run and reward its investors with noteworthy risk-adjusted returns.

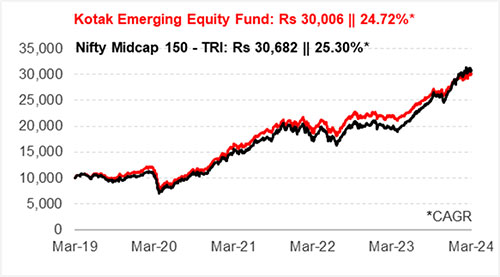

What is the growth of Rs 10,000 invested in Kotak Emerging Equity Fund five years ago?

Past performance is not an indicator of future returns

Data as of March 01, 2024

(Source: ACE MF, data collated by PersonalFN)

Incepted in March 2007, Kotak Emerging Equity Fund is positioned as a midcap-biased fund that seeks to identify the hidden growth potential of mid-sized companies. The fund is of the view that since mid-cap companies are relatively under-researched, they can provide opportunities to exploit the gaps between the prevailing market price and intrinsic value. Kotak Emerging Equity Fund was primarily a mid and small-cap fund but was later recategorised as a Midcap Fund to align with the SEBI’s classification norm in 2017. Accordingly, the fund holds a mid-cap biased portfolio, along with significant exposure to small caps, and a balanced allocation towards large caps.

The fund holds a sizeable portfolio of quality stocks spread across sectors and picked by utilising a bottom-up investment strategy. During the mid-cap crash of 2018-19 and the market turbulence of 2020, Kotak Emerging Equity Fund displayed remarkable strength, distinguishing itself from many of its peers who struggled to keep pace with the market returns. Moreover, the fund also outpaced several of its peers in the ensuing bull phase. This impressive performance has solidified its position as one of the top performers within the Mid Cap Fund category in the long run.

With a compounded annualised return of around 24.7% over the past 5 years, Kotak Emerging Equity Fund’s performance has been nearly in line with its benchmark Nifty Midcap 150 – TRI index. An investment of Rs 10,000 in Kotak Emerging Equity Fund 5 years back would have grown to Rs 30,006. A simultaneous investment in the benchmark would now be worth Rs 30,682.

How has Kotak Emerging Equity Fund performed on a rolling return basis?

| Scheme Name | Corpus (Cr.) | 1 Year | 2 Year | 3 Year | 5 Year | 7 Year | Std Dev | Sharpe |

| Quant Mid Cap Fund | 4,858 | 27.58 | 23.90 | 39.89 | 25.08 | 21.01 | 17.64 | 0.50 |

| SBI Magnum Midcap Fund | 15,957 | 23.64 | 18.10 | 34.21 | 19.82 | 15.86 | 14.43 | 0.37 |

| HDFC Mid-Cap Opportunities Fund | 59,027 | 33.84 | 22.44 | 34.18 | 19.12 | 17.99 | 14.92 | 0.45 |

| Nippon India Growth Fund | 24,366 | 29.85 | 19.81 | 33.42 | 20.65 | 18.71 | 15.81 | 0.41 |

| Mirae Asset Midcap Fund | 14,362 | 22.79 | 15.70 | 32.25 | — | — | 15.31 | 0.36 |

| Kotak Emerging Equity Fund | 39,027 | 22.34 | 16.40 | 31.48 | 19.98 | 18.49 | 13.77 | 0.36 |

| Sundaram Mid Cap Fund | 10,112 | 25.89 | 16.83 | 28.42 | 14.38 | 13.77 | 15.20 | 0.33 |

| Franklin India Prima Fund | 10,081 | 24.90 | 13.16 | 25.79 | 14.83 | 14.56 | 15.94 | 0.28 |

| Axis Midcap Fund | 24,534 | 17.92 | 10.79 | 23.96 | 18.59 | 18.65 | 14.52 | 0.28 |

| DSP Midcap Fund | 16,556 | 20.32 | 9.05 | 20.54 | 14.81 | 14.77 | 15.08 | 0.23 |

| Nifty Midcap 150 – TRI | 28.74 | 17.81 | 32.61 | 18.56 | 18.16 | 16.63 | 0.38 |

The securities quoted are for illustration only and are not recommendatory.

Returns are on a rolling basis and in %. Direct Plan-Growth option. Those depicted over 1-Yr are compounded annualised. Risk ratios are calculated over a 3-year period assuming a risk-free rate of 6% p.a.

Data as of March 01, 2024

(Source: ACE MF, data collated by PersonalFN)

Please note, this table only represents the best-performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully before investing. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

In the past Kotak Emerging Equity Fund exhibited consistency in terms of performance and held a noteworthy track record of generating market-beating returns across most time periods. Notably, in the last couple of years, Kotak Emerging Equity Fund has trailed the benchmark and some of its prominent peers. This has impacted its near-term returns. That said, the fund has the potential to make a comeback and reward investors reasonably over the long run.

Over the longer 5-year and 7-year rolling return basis, Kotak Emerging Equity Fund stands among the category toppers and has also fared well compared to the benchmark.

In terms of risk-reward parameters, the volatility registered by the fund is among the lowest in the category and lower than the benchmark index. Its Sharpe Ratio (0.36) signifying the risk-adjusted returns outscores many of its peers though it is slightly lower than the benchmark.

[Read: Rally in Mid Cap and Small Cap Funds: Should You Buy More or Sell Now?]

What is the investment strategy of Kotak Emerging Equity Fund?

Classified under the Mid Cap Fund category, Kotak Emerging Equity Fund is mandated to invest a minimum of 65% of its assets in mid-cap stocks. Accordingly, the fund holds a predominant mid-cap biased portfolio. It holds significant exposure across large-cap and small-cap stocks as well. Kotak Emerging Equity Fund makes good use of diversification and invests in over 70 stocks spread across sectors in its portfolio.

Kotak Emerging Equity Fund aims to identify the hidden potential of midsized companies by utilising the bottom-up stock selection approach. It seeks to invest in companies that are either at their nascent or developing stage and are under-researched but have the potential to deliver higher growth in the long term. The scheme aims to invest across sectors and follows a buy-and-hold strategy to derive the full potential of the stocks.

Kotak as an AMC endeavours to invest in stocks, which, in the opinion of the fund manager, are priced at a material discount to their intrinsic value. The process of discovering the intrinsic value is through in-house research supplemented by research available from other sources. The potential of stocks is guided by considerations such as the financial parameters of the company, reputation of the management and their track record, companies that are less prone to recessions or cycles, companies that pursue a strategy to build strong brands for their products or services, market liquidity of the stock, and so on.

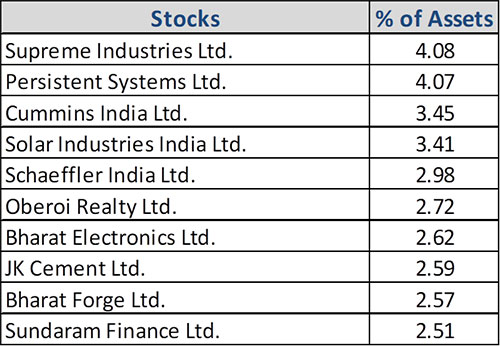

What are the top portfolio holdings in Kotak Emerging Equity Fund?

|  |

Holding in (%) as of January 31, 2024

(Source: ACE MF, data collated by PersonalFN)

Kotak Emerging Equity Fund usually holds a diverse portfolio, investing in over 70 stocks spread across 20 sectors. As of January 31, 2024, the fund held 78 stocks in its portfolio with the top 10 stocks together constituting around 31% of its assets. Supreme Industries is currently the top holding in its portfolio having an allocation of about 4.1% followed by Persistent Systems, Cummins India, Solar Industries India, and Schaeffler India among others. Most of these stocks have been a part of its portfolio for over two years now. The fund manager typically has conviction in some of the core stock holdings in the portfolio and accordingly, Kotak Emerging Equity Fund usually records a low turnover of less than 5%.

Names like Solar Industries India, Supreme Industries, Persistent Systems, Cummins India, Bharat Electronics, Schaeffler India, Ratnamani Metals & Tubes have contributed immensely to the Kotak Emerging Equity Fund’s performance in the last 2 years. It also benefitted hugely from its holdings in Thermax, Torrent Pharma, Oberoi Realty, Jindal Steel & Power, Blue Star, APL Apollo Tubes, and MRF among many others.

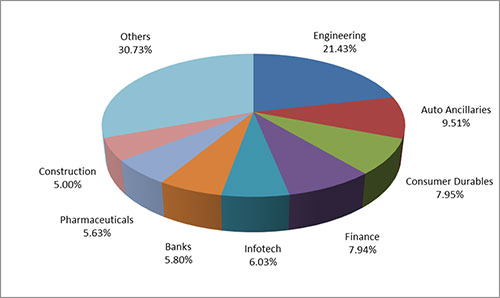

In terms of sector, Engineering tops the list of allocation with an exposure of around 21.4% followed by Financial Services at about 13.7%. All other sectors have allocation well within the 10% mark. Auto Ancillaries, Consumer Durables, Infotech, Pharma, Construction, Cement, Fertilisers, and Metals are among the other core sectors in the fund’s portfolio. The top 10 sectors together account for around 78% of its assets. Though Kotak Emerging Equity Fund’s portfolio is inclined more towards Cyclicals and Sensitive sectors, it is fairly diversified to Defensive sectors as well.

Is Kotak Emerging Equity Fund suitable for my investment goals and risk tolerance?

Kotak Emerging Equity Fund has established a proven track record of generating returns that exceed the category average across various market conditions. Even in turbulent market conditions, it has remained steadfast, while its involvement in upward market trends has been notable as well.

Earlier managed by veteran fund manager Mr Pankaj Tibrewal, the fund is now under the supervision of Mr Atul Bhole. Despite the recent change in the fund management team, the scheme continues to focus on identifying high-conviction stocks of superior quality within the mid-cap space and holding them with a long-term view has proven beneficial. Moreover, the fund’s ability to deliver superior risk-adjusted returns has been notably commendable.

Belonging to a process-driven fund house, Kotak Emerging Equity Fund is well-placed to capture attractive opportunities across sectors and reward investors with superior risk-adjusted returns in the long run.

Kotak Emerging Equity Fund is suitable for investors who can bear the higher volatility associated with the mid-cap space and have an investment horizon of at least 5-7 years.

Watch this video to find out the best Mid Cap Mutual Funds for 2024:

Note: This write up is for information purpose and does not constitute any kind of investment advice or a recommendation to Buy / Hold / Sell a fund. Returns mentioned herein are in no way a guarantee or promise of future returns. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

This article first appeared on PersonalFN here